How to price Forward Rate Agreements (FRA)

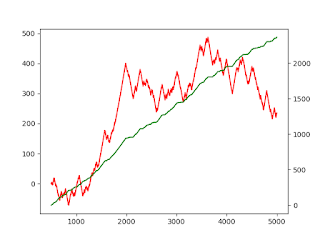

Forward Rate Agreements: FRAs are used to lock in interest rates for a future date. They are based on the principle that there can be no arbitrage profits between investing for two different horizons. In an increasing interest rate environment, the final calculated value will be higher than each of the horizons used to perform the calculations.

FRA Conventions: A 3 x 9 FRA means an FRA contract that will go live in 3 months, and the contract will be for a duration of (9-3) = 6 months

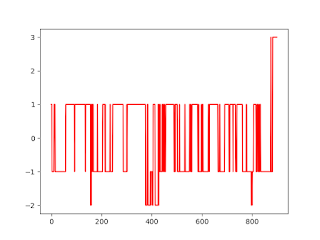

FRA valuation: The FRA can be valued at any point in time, as the difference between the agreed rate and the current rate, multiplied by the nominal value, and discounted to the present

Comments

Post a Comment